EXHIBIT 99.1

Published on December 18, 2025

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus does not constitute an offer to see or the solicitation of an offer to buy any securities. This non-offering prospectus does not constitute a public offering of securities.

PROSPECTUS

| Non-Offering Prospectus | December 17, 2025 |

|

STARFIGHTERS SPACE, INC.

No securities are being offered pursuant to this Prospectus.

This non-offering prospectus (the "Prospectus") is being filed with the securities regulatory authority in the Province of British Columbia to enable Starfighters Space, Inc. (the "Corporation" or "Starfighters") to become a "reporting issuer" in the Province of British Columbia under the Securities Act (British Columbia), notwithstanding that no sale of securities is contemplated herein.

Since no securities are being offered pursuant to this Prospectus, no proceeds will be raised, and all expenses incurred in connection with the preparation and filing of this Prospectus will be paid by the Corporation from its general corporate funds.

The Corporation has filed a registration statement on Form 8-A (the "Registration Statement") with the United States Securities and Exchange Commission (the "SEC"), for the purpose of registering its securities under section 12(b) of the U.S. Securities Exchange Act of 1934 (the "Exchange Act") in connection with the listing of the Corporation's common shares ("Common Shares") on the NYSE American LLC ("NYSE American"). The Registration Statement was declared effective by the SEC on December 12, 2025. NYSE American has approved the listing of the Common Shares for trading on under the symbol "FJET", effective as of December 18, 2025 (the "Listing Date").

The Company is a "SEC issuer" as such term is defined under National Instrument 51-102 - Continuous Disclosure Obligations.

No underwriter or selling agents have been involved in the preparation of this Prospectus or performed any review or independent due diligence of the contents of this Prospectus.

As contemplated by Part 19 of National Instrument 41-101 General Prospectus Requirements ("NI 41-101"), on December 3, 2025, the Corporation applied for exemptive relief from the requirement in section 2.3(1.1) of NI 41-101 to file its final prospectus no later than 90 days from September 5, 2025. The exemption granted will be evidenced by the issuance of a receipt for this Prospectus, as contemplated under section 19.3 of NI 41-101.

The Corporation is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction and each of Rick Svetkoff, Tim Franta, Brian Goldmeier, and Geoff Hickman, directors of the Corporation, reside outside Canada. The Corporation, Rick Svetkoff, Tim Franta, Brian Goldmeier, and Geoff Hickman have appointed McMillan LLP, having an office at 1055 West Georgia Street, Suite 1500, Vancouver, British Columbia, V6B 4N7 as their agent for service of process.

Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

An investment in securities of the Corporation is speculative and involves a high degree of risk. In reviewing this Prospectus, you should carefully consider the matters described under the heading "Risk Factors".

The Corporation must obtain a launch license from the U.S. Federal Aviation Administration ("FAA") Office of Commercial Space Transportation to operate the "Launch Services" and "Access to Space" portion of its business objectives. See "Business Objectives and Milestones - Regulatory Compliance."

The Corporation's head office and mailing address is Reusable Launch Vehicle Hangar, Hangar Road, Cape Canaveral, Florida, 32920, and the Corporation's phone number is 321-261-0900. The Corporation's registered and records office is located at 850 New Burton Road, Suite 201, Dover, Delaware, 19904. The Corporation's website address is https://starfightersspace.com/. The information contained therein or accessible thereby shall not be deemed to be incorporated into this Prospectus.

TABLE OF CONTENTS

Page

FORWARD-LOOKING STATEMENTS

This Prospectus contains forward-looking statements and forward-looking information within the meaning of applicable securities legislation about the Corporation and the development of its business. The use of any of the words "may", "will", "should", "expect", "anticipate", "continue", "plan", "estimate", "believe", "intend", "project", "forecast", and other similar expressions is intended to identify forward-looking statements or information.

The cautionary statements set forth in this Prospectus, including in "Risk Factors" and elsewhere, identify important factors which you should consider in evaluating the Corporation's forward-looking statements. These factors include, among other things:

-

The Corporation has a limited operating history in an evolving industry, making it difficult for the Corporation to forecast revenue, plan expenses, and evaluate its business and future prospects;

-

The Corporation has a history of losses and ability to achieve profitability;

-

The Corporation's ability to raise capital and the availability of future financing;

-

The Corporation's business involves significant risks and uncertainties that may not be covered by insurance;

-

The Corporation's business with governmental entities is subject to the policies, regulations, mandates, and funding levels of such entities and may be negatively impacted by any change thereto;

-

The Corporation may not be successful in developing new technology, and technology the Corporation does develop may not meet the needs of its customers;

-

The Corporation operates in competitive industries in various jurisdictions across the world;

-

The Corporation is highly dependent upon the services of Mr. Svetkoff, the Corporation's Chief Executive Officer, and if the Corporation is unable to retain Mr. Svetkoff, the Corporation's ability to compete could be harmed; and

-

The Corporation depends on several specialized suppliers for the majority of specialized supply needs. Disruptions in the supply of key raw materials or component and difficulties in the supplier qualification process, as well as increases in prices of raw materials, could adversely impact the Corporation.

The forward-looking statements and information contained in this Prospectus are based on certain key expectations and assumptions made by the Corporation, including expectations and assumptions relating to the purchase of the Platform II Aircraft, the next testing stage with the U.S. Federal Aviation Administration ("FAA"), the drop test, full commercial service, pilot training and testing capabilities, among other things. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including the risks in the section entitled "Risk Factors", which may cause the Corporation's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although the Corporation has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

The forward-looking statements and information contained in this Prospectus are made as of the date hereof and, unless so required by applicable law, the Corporation undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise. The forward-looking statements and information contained in this Prospectus are expressly qualified by this cautionary statement.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

In this Prospectus, unless otherwise indicated, all references to "$" or "dollars" refer to United States Dollars, all references to "CAD$" refer to Canadian Dollars.

On December 16, 2025, the daily exchange rate for Canadian Dollars in terms of the United States Dollar as quoted by the Bank of Canada, was CAD$1.3748 = $1.00.

GLOSSARY

The following is a glossary of certain general terms used in this Prospectus. Terms and abbreviations used in the financial statements and management's discussion and analysis included in, or appended to this Prospectus are defined separately and the terms and abbreviations defined below are not used therein, except where otherwise indicated. Words importing the singular, where the context requires, include the plural and vice versa and words importing any gender include all genders.

"2022 Warrants" has the meaning ascribed to it in "Description of Securities - Warrants - 2022 Warrants".

"2023 Warrants" has the meaning ascribed to it in "General Description of the Business - History".

"Adjusted Rate" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"Aerovision" means Aerovision LLC, a Florida limited liability company.

"Aircraft Agreement" has the meaning ascribed to it in "General Description of the Business - Our Products and Services".

"Aircraft Transactions" has the meaning ascribed to it in "General Description of the Business - Our Products and Services".

"Amended and Restated 2023 Stock Incentive Plan" means the Corporation's 2023 Stock Incentive Plan that the Board authorized, confirmed, and approved on October 27, 2023, as amended on August 12, 2025.

"Amended Maturity Date" has the meaning ascribed to it in "General Description of the Business - History".

"Amendment Effective Date" has the meaning ascribed to it in "General Description of the Business - History".

"Amendment to Loan and Security Agreements" has the meaning ascribed to it in "General Description of the Business - History".

"AST" means the FAA Office of Commercial Space Transportation.

"Audit Committee" means the audit committee of the Corporation.

"Audit Committee Charter" or "Charter" means the Audit Committee Charter that is governed by and operates under the Audit Committee, adopted by the Board of Directors on April 17, 2024.

"Board of Directors" or "Board" means the board of directors of the Corporation.

"Bridge Financing" has the meaning ascribed to it in "

Description of Securities - 2022 Warrants".

"Bylaws" means the bylaws of the Corporation.

"Certificate of Incorporation" means the certificate of incorporation of the Corporation.

"Common Shares" means the common shares in the capital of the Corporation.

"Compensation Committee" means the compensation committee of the Corporation.

"Computershare" means Computershare Trust Company of Canada.

"Continental" means Continental Airlines.

"Conversion Amount" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"Conversion Shares" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"Corporation" or "Starfighters" means Starfighters Space, Inc., a company incorporated under the laws of the State of Delaware on September 6, 2022.

"Debentures" has the meaning ascribed to it in "General Description of the Business - History".

"Debentureholders" has the meaning ascribed to it in "General Description of the Business - History".

"Definitive Aircraft Agreement" has the meaning ascribed to it in "General Description of the Business - Our Products and Services".

"Discharged Security Interests" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"DoC" means the U.S. Department of Commerce.

"DoD" means the U.S. Department of Defense.

"DoS" means the U.S. Department of State.

"DoT" means the U.S. Department of Transportation.

"Economic Development Agreement" has the meaning ascribed to it in "General Description of the Business - Property".

"EPS" means basic earnings per share.

"Equity Exchange Agreement" means the equity exchange agreement dated September 9, 2022 between the Corporation and Rick Svetkoff for the acquisition of Starfighters International.

"Exchange Act" means the U.S. Securities Exchange Act of 1934.

"F2" means F2 Florida, LLC.

"FAA" means U.S. Federal Aviation Administration.

"FAR" means Federal Acquisition Regulation.

"FIC" means Fortuna Investment Corp.

"GAAP" means the Generally Accepted Accounting Principles.

"Governance Committee" means the governance committee of the Corporation.

"HGI" means Hypersonic Group Inc.

"Historical Services" means pilot and astronaut training and in-flight testing related services provided by the Corporation.

"HyCAT" means the Hypersonic and High-Cadence Airborne Testing Capabilities initiative that the Corporation is involved with in partnership with Innoveering LLC and under the auspices of the Defense Innovation Unit of the U.S. Department of Defense.

"Hypersonic APA" means the asset purchase agreement entered into by Starfighters International with HGI dated October 1, 2021, as amended on December 29, 2023.

"KSC" means NASA's Kennedy Space Center.

"Lease Agreement" means Lease Agreement No: C20756 between Space Florida and Starfighters International dated June 1, 2022, as amended on June 1, 2023.

"Listing Date" means the date the Common Shares will become listed for trading on the NYSE American, being December 18, 2025.

"Little Hill" means Little Hill Holdings, LLC.

"Little Hill Consulting Agreement" has the meaning ascribed to it in "General Description of the Business - History".

"LH Warrants" has the meaning ascribed to it in "General Description of the Business - History".

"Lockheed F-104" means a flight-ready F-104 supersonic aircraft.

"Maturity Date" has the meaning ascribed to it in "General Description of the Business - History".

"Meeting" has the meaning ascribed to it in "General Description of the Business - History".

"MD&A" means management's discussion and analysis.

"MDC" means Midland Development Corporation, a Type A corporation pursuant to Chapter 504 of the Texas Local Government Code, as amended.

"MOA" means the Memorandum of Agreement dated March 28, 2023, which the Corporation, through Starfighters International, is a party to with SLD45.

"Named Executive Officer" or "NEO" means each of the following individuals of the Corporation;

(a) a chief executive officer ("CEO") of the Corporation;

(b) a chief financial officer ("CFO") of the Corporation;

(c) a chief operating officer ("COO") of the Corporation;

(d) each of the Corporation's three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO, CFO and COO, at the end of the most recently completed financial year whose total compensation was, individually, more than CAD$150,000, as determined in accordance with subsection 1.3(6) of Form 51-102F6, for that financial year; and

(e) each individual who would be an NEO under paragraph (d) above but for the fact that the individual was neither an executive officer, and was not acting in a similar capacity, at the end of that financial year.

"NASA" means National Aeronautics and Space Administration.

"Navy" means the U.S. Navy.

"New Services" means new opportunities for Starfighters based on the increased demand for space access, particularly in lower earth orbits as well as the government and private sector's focus on hypersonic research and development.

"NI 52-110" means National Instrument 52-110 - Audit Committees.

"NI 58-101" means National Instrument 58-101 - Disclosure of Corporate Governance Practices.

"Options" means options to purchase Common Shares under the Amended and Restated 2023 Stock Incentive Plan.

"Option Share" means a Common Share to be issued upon exercise of an Option.

"Platform II Aircraft" means the additional newer model aircraft to modernize the Corporation's fleet.

"Premises" has the meaning ascribed to it in "General Description of the Business - Property".

"Property Vista" means Property Vista Software Inc.

"Prospectus" means this non-offering prospectus.

"Public Listing" means the event whereby the Common Shares are listed on the NYSE American or any United States stock exchange.

"Purchase Price" has the meaning ascribed to it in "General Description of the Business - Suppliers".

"Rate Adjustment Date" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"R&D" means Research and Development.

"Reg A Offering" means the Corporation's Tier 2 offering pursuant to Regulation A under the Securities Act of 1933 (United States), as amended (the "Securities Act"), completed on December 17, 2025.

"RentMoola" means RentMoola Payment Solutions Inc.

"RLB" means RLB Aviation Inc.

"ROU" means rights of use.

"RSU" means restricted stock unit under the Amended and Restated 2023 Stock Incentive Plan.

"SARs" means stock appreciation rights.

"SEC" means the Securities and Exchange Commission.

"Sea Island" means Sea Island Consulting Ltd.

"SFI" means Starfighters, Inc., a wholly owned subsidiary of the Corporation, which was formed pursuant to the laws of Florida on November 16, 2005 and is owned indirectly by the Corporation through Starfighters International.

"SLD45" means Space Launch Delta 45.

"Space Florida" means an independent special district, a body politic and corporate, and a subdivision of the State of Florida.

"Space Florida Collateral" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"Space Florida Loan" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"Space Florida Loan Agreement" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"Space Florida Loan Documents" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"Space Florida Promissory Note" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"Space Florida Security Agreement" has the meaning ascribed to it in "Description of Material Indebtedness - Notes Payable".

"Starfighters International" means Starfighters International, Inc., a wholly owned subsidiary of the Corporation, which was formed pursuant to the laws of the State of Florida on December 3, 2018.

"Starfighters Texas" means Starfighters International, Inc. (formerly, Starfighters Texas, Incorporated), a wholly owned subsidiary of the Corporation, which was formed pursuant to the laws of the State of Texas on March 29, 2024.

"StarLaunch" means the Corporation's delivery platform core component, including the development, testing, certifying, and licensing of the Corporation's rocket family.

"StarLaunch II" has the meaning ascribed to it in "General Description of the Business - Our Products and Services".

"T&E" means Test and Evaluation.

"Vesting Date" has the meaning ascribed to it in "General Description of the Business - History".

"Vurger" means The Vurger Co. Ltd.

"Warrant" means a Common Share purchase warrant.

"Warrant Share" means a Common Share to be issued upon exercise of a Warrant.

SUMMARY OF PROSPECTUS

The following is a summary of the information contained in this Prospectus and should be read together with the more detailed information and financial data and statements contained elsewhere in this Prospectus.

Capitalized terms used in this summary, which are not defined in the summary, have the meanings ascribed to them elsewhere in this Prospectus. Unless otherwise indicated, references to the "Corporation", "we", "us" and similar terms are to Starfighters Space, Inc.

The Corporation

The Corporation was founded and incorporated under the laws of the State of Delaware on September 6, 2022. The Corporation's goal is to make space accessible to entrepreneurs, researchers, industry participants, and the government at a high cadence and the right cost. All non-current assets of the Corporation are located in the United States. See "Corporate Structure" and "General Description of the Business".

Use of Available Funds

No securities are being offered and no proceeds will be raised pursuant to this Prospectus. The Corporation's available cash has been used and will continue to be used, to the extent required, to fund its negative cash flow and for the principal purposes set out in this Prospectus. However, there may be circumstances where, for business reasons, a reallocation of funds or further financing may be necessary. See "Use of Available Funds".

Risk Factors

An investment in the Corporation's securities involves a significant degree of risk. An investment in the Common Shares or other securities of the Corporation should be considered highly speculative due to the nature of the Corporation's business and its stage of development, nature of the industry and evolving regulations, and should be considered only by investors who can afford the total loss of their investment. There are certain factors and risks which should be considered when evaluating an investment in the Corporation, including, but not limited to: ability of the Corporation to continue its operations; the market developing at a slow rate; ability of the Corporation to adapt to new laws and government regulations; ability of the Corporation to compete with both direct and indirect competition; dependence on the Corporation's management team to operate the business; litigation; dependence on business relationships with various governmental and private entities; changes to tax policies regarding the Corporation's business; ability of the Corporation to maintain a sustainable order rate for its products and services; dependence of the Corporation on specialized suppliers; adverse media attention and public pressure; foreign currency risk; ability of the Corporation to comply with securities laws; no cash dividends in the foreseeable future; no market for the Common Shares; illiquidity and price volatility of the Common Shares; ability of the Corporation to implement its business plan, raise capital, and generate revenues; limited operating results; lack of working capital; ability of the Corporation to manage growth; and potential political risks on the Corporation's business. These categories of risk are not comprehensive and additional risks are disclosed elsewhere in this Prospectus. See "Risk Factors".

Summary of Financial Information

The following selected financial information for the Corporation is derived from and is qualified in its entirety by the audited consolidated financial statements of the Corporation for the years ended December 31, 2024 and 2023, including the notes thereto (included as Schedule "B" to this Prospectus) and the unaudited interim financial statements of the Corporation for the three and nine months ended September 30, 2025 and 2024, including the notes thereto (included as Schedule "A" to this Prospectus), and should be read in conjunction with the respective MD&A for such periods. The Corporation's consolidated financial statements were prepared and presented in accordance with U.S GAAP and are expressed in United States Dollars.

| Starfighters Space, Inc. | Nine months ended September 30, 2025 (unaudited) ($) |

Year ended December 31, 2024 (audited) ($) |

Year ended December 31, 2023 (audited) ($) |

| Revenue | Nil | Nil | Nil |

| Current assets | 4,451,683 | 8,352,629 | 2,140,733 |

| Liabilities | 17,731,059 | 16,191,042 | 11,567,680 |

| Total assets | 12,235,764 | 10,300,586 | 3,631,392 |

| Net Income (Loss) | (6,261,319) | (7,908,777) | (4,681,583) |

| Loss per share | (0.30) | (0.46) | (0.28) |

| Total shareholders' equity (deficit) | (5,495,295) | (5,890,456) | (7,936,288) |

See "Selected Financial Information of the Corporation and Management's Discussion and Analysis".

CORPORATE STRUCTURE

Name, Address, and Incorporation

The Corporation was founded and incorporated under the laws of the State of Delaware on September 6, 2022. The Corporation's goal is to make space accessible to entrepreneurs, researchers, industry participants, and the government at a high cadence and the right cost. All non-current assets of the Corporation are located in the USA.

The Corporation's head office and mailing address is located at Reusable Launch Vehicle Hangar, Hangar Road, Cape Canaveral, Florida, 32920. The Corporation's registered and records office is located at 850 New Burton Road, Suite 201, Dover, Delaware, 19904.

Intercorporate Relationships

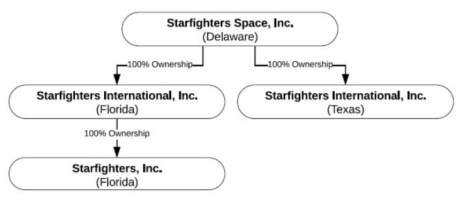

The Corporation has three wholly owned subsidiaries:

(i) Starfighters International, Inc. (formerly, Starfighters Texas, Incorporated) ("Starfighters Texas"), which was formed pursuant to the laws of the State of Texas on March 29, 2024;

(ii) Starfighters International, Inc. ("Starfighters International"), which was formed pursuant to the laws of the State of Florida on December 3, 2018; and

(iii) Starfighters, Inc. ("SFI"), which was formed pursuant to the laws of the State of Florida on November 16, 1995. SFI is owned indirectly by the Corporation through Starfighters International.

Set forth below is the organizational chart for the Corporation:

GENERAL DESCRIPTION OF THE BUSINESS

Our Business

The Corporation's mission statement is to make space accessible to entrepreneurs, researchers, industry, and government at a high cadence and the right cost.

Currently, the Corporation operates the world's only commercial fleet of flight-ready F-104 supersonic aircraft ("Lockheed F-104"). The Lockheed F-104 was developed as a supersonic aircraft for the United States Armed Forces. The single engine interceptor was favoured for its maximum altitude and climb performance. It was the first production aircraft to reach over MACH 2 in sustained, level flight, which was one of the key criteria as to why the National Aeronautics and Space Administration ("NASA") used the Lockheed F-104 for high-speed flight research at the Dryden Flight Research Center. The Lockheed F-104 also performed many safety chase missions in support of advanced research aircraft and provided a launch platform for sounding rockets.1 Test flights showed that a Lockheed F-104 launched single-stage Viper sounding rocket attain a maximum 112km in altitude.2 In total, the Lockheed F-104 flew over 18,000 missions for NASA. NASA retired the Lockheed F-104 in 1995,3 with transition to the McDonnell Douglas F/A-18 Hornet supersonic Aircraft.4

1 Jarosław Dobrzyński, Lockheed F-104 Starfighter, Yellow Series (Mushroom Model Publications, 2015).

2 "F-104 Launched Sounding Rockets" (22 June 2012), online (blog): <up-ship.com/blog/?p=14946>.

3 NASA, "F-104 Starfighter" (27 September 2009), online <nasa.gov/image-article/f-104-starfighter-11/>.

4 Roy Bryant, "The Lockheed F104s of NASAs Flight Research Center" (February 2004), online (pdf): <916-starfighter.de/StarsofNASA_WingsMagazine.pdf >.

Recent increases in government expenditures and commercial investment are driving growth in the space economy.5 The Corporation believes this increase has created a demand for services similar to those that Lockheed F-104s formerly owned by NASA used to provide. That demand is for commercial, research, and defense technologies including hypersonic research.6 To the Corporation's knowledge, there is currently no other aircraft commercially available to the public with the capabilities of the Lockheed F-104 in terms of speed and climbing performance.

The Corporation has built a consistent business by providing pilot and astronaut training and in-flight testing related services (the "Historical Services"), delivering over its history, solutions for defense, civil, academic and commercial uses, and expects to continue to serve a range of customers in the private and public sectors. Furthermore, we believe the increased demand for space access, particularly in lower earth orbits as well as the government and private sector's focus on hypersonic research and development combine to create new opportunities for Starfighters (the "New Services").

The Corporation aims to address these needs through its existing fleet of seven Lockheed F-104 Aircraft, currently based at NASA's Kennedy Space Center ("KSC") and Midland International Air & Space Port ("MIASP"), as well as through the acquisition of the Platform II Aircraft which the Corporation believes will provide more advanced capabilities and have a longer operating lifespan.

Starfighters is providing its core group of Historical Services, while developing the capacity for New Services. The Corporation organizes its services into the following categories:

Historical Services:

- Pilot and Astronaut Training;

- Launch Services and Access to Space; and

- In-flight Testing.

New Services:

- Launch Services and "Access to Space" (commercial, academic, civil and government clients); and

- Airborne Testbed for Hypersonic Research and Development ("R&D") and Test and Evaluation ("T&E") Test Bed (commercial, academic, civil and government).

Our Products and Services

Historically, Starfighters generated the majority of its income from its Historical Services of pilot training and in-flight testing, and continues to do so today. We expect the demand for our Historical Services to grow with the evolution of commercial supersonic flight. The Corporation also plans to expand into new lines of services and potential revenue, being the New Services. As the commercialization of space has accelerated, the Corporation believes there is an opportunity to utilize its fleet to fill what we believe is a growing need for strategic access to space and airborne testing for the next generation of hypersonic air-launched rockets and commercial supersonic aircraft. For the last two years, the Corporation has been developing two new lines of business, Launch Services and Hypersonic R&D and T&E. The New Services form the foundation of the Corporation's growth plan. In 2023, the Corporation announced its first testing agreements and is working to expand those services. During the year, the Corporation also flew pilot training missions for Boom Supersonic, a commercial supersonic aircraft developer. At the same time, the Corporation elected to co-develop its second stage launch system (referred to as StarLaunch I) with Innoveering, LLC, which was acquired by GE Aeronautics in late 2022.

5 Stefan Ellerbeck, "The Space Economy Is Booming. What Benefits Can It Bring to Earth?" (19 October 2022), online: <https://www.weforum.org/stories/2022/10/space-economy-industry-benefits/>.

6 U.S. Naval Institute Staff, "Report to Congress on Hypersonic Weapons" (16 February 2024), online: <news.usni.org/2024/02/16/report-to-congress-on-hypersonic-weapons-12 >.

Launch Services

As the Corporation has identified access to space as becoming increasingly in demand for both government and commercial interests, we identified a new use for our platform. The Starfighters fleet could act as horizontally-launched, piloted vehicles capable of acting as a first stage in launching smaller payloads into space. The Corporation is now in the process of developing a second stage rocket, StarLaunch I, capable of carrying smaller payloads into space. To that end, the Corporation has partnered with GE Aeronautics to develop a prototype StarLaunch I, a proprietary design, underwing, air-launch rocket capable of carrying small payloads into space in a manner that the Corporation believes can be more economical and with reduced turnaround and relaunch time compared to traditional rockets. The Corporation believes a further advantage in its development process is the ability to use a proven military aircraft, such as the Lockheed F-104, in conjunction with the StarLaunch I rocket which is initially based on the proven design and current missile technology.

The StarLaunch I family of rockets is designed to use the Lockheed F-104 as the first stage of the rocket. This carries advantages of reliability, reusability, control, and reduced cost. The StarLaunch I rocket is designed to carry payloads to sub-orbital altitudes. In 2023, the Corporation began to explore options for the ability of its fleet to carry larger payloads further into space. The rocket that will carry payloads to orbit has been named StarLaunch II.

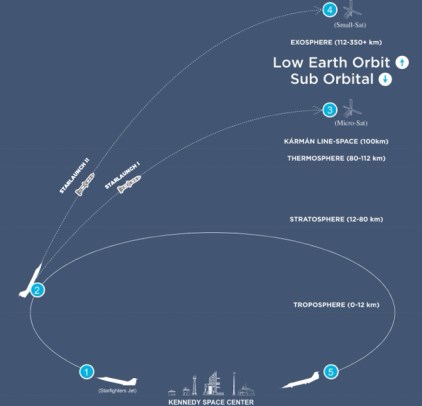

The launch process:

1. The Corporation's first stage aircraft launches from a traditional runway without the need for derrick or cranes;

2. The Corporation's first stage aircraft reaches critical height and launches the StarLaunch second stage rocket, with the optimum height being dependent on the mission;

3. StarLaunch I boosts to suborbital altitude and deploys payloads;

4. StarLaunch II boosts to low earth orbit and deploys small-satellites; and

5. The Corporation's first stage aircraft lands, refuels, reloads for additional missions.

The Corporation has completed the underwing captive carry test with the FAA using the National Research Council of Italy's Aviolancio rocket platform. This milestone marks the first phase of flight testing. Separately, the Corporation has commenced development of its dedicated launch platform, StarLaunch I. Currently the StarLaunch I Test Article's External Surface Engineering is complete, and the Corporation is on track for flight testing in Q2/Q3 2025. Subject to securing requisite regulatory approvals and adequate funding, Starfighters targets its first commercial launch by year-end 2025. A successful launch and associated compliance will assist the Corporation in obtaining a five-year FAA launch license. See "Business Objectives and Milestones" and "Government Regulation".

Aircraft Agreement with Aerovision

The Corporation has identified a potential solution in the Platform II Aircraft, and is in negotiations to acquire the aircraft and support materials.

On October 31, 2024, the Corporation entered into an aircraft acquisition agreement (the "Aircraft Agreement") with Aerovision LLC, a Florida limited liability company ("Aerovision"), pursuant to which Starfighters International, the Corporation's wholly owned subsidiary, agreed to purchase from Aerovision various used aircraft and associated spare equipment (the "Aircraft Transactions") in phases. The Aircraft Agreement contemplates that each Aircraft Transaction will be completed pursuant to a definitive agreement (each, a "Definitive Aircraft Agreement") to be settled between the parties, in each case with a corresponding bill of sale and associated closing documents. The Aircraft Agreement provides that it, and any Definitive Aircraft Agreement entered into by the parties, may be amended and/or extended in writing by the parties on a case-by-case basis. The subject aircraft for acquisition pursuant to the Aircraft Agreement are: (i) twelve F-4 Phantom II aircraft, (ii) one MD-83 with FAA Registration N572AA, and (iii) one DC-9 with FAA Registration N932NA. The subject aircraft are used-serviceable surplus aircraft offered on an "as-is-where-is" basis, with no warranty express or implied. The twelve F-4 Phantom II aircraft have recently been decommissioned by the Republic of Korea Air Force, and will have to be registered with the FAA after they are imported into the United States from South Korea. The Corporation is aiming to complete the purchase of its Platform II Aircraft by Q4 2025, and has already been recommended as the next generation test and launch bed by the United States Air Force Research Lab.

The Aircraft Agreement requires an initial deposit advance in the amount of $5,000,000 to be made no later than ten (10) business days from the signing of the Aircraft Agreement, which has been paid from funds received from the Reg A Offering. The payment of the deposit is considered to constitute "Phase 1" under the Aircraft Agreement. Phase 2 involved the payment of an additional $5,000,000 for the acquisition of eight of the twelve F-4 Phantom II aircraft. Such payment was due no later than December 15, 2024. Phase 3 involved the payment of an additional $5,000,000 for the acquisition of the final four F-4 Phantom II aircraft. Such payment was due no later than March 15, 2025. Phase 4 involved the payment of an additional $5,000,000 for the acquisition of the MD-83 aircraft with FAA Registration N572AA, and the DC-9 aircraft with FAA Registration N932NA. The parties were to use their reasonable best efforts to complete Phase 4 by April 15, 2025.

Amendment to Aircraft Agreement

As a result of the current political situation in South Korea, Starfighters International has been unable to view the F-4 Phantom II aircraft originally contemplated under the Aircraft Agreement to be acquired from the Republic of South Korea Air Force, and neither Starfighters International nor Aerovision have been able to confirm the continued availability of such aircraft. As such, Starfighters International did not pay the Phase 1 initial deposit advance nor the Phase 2 payment provided for under the Aircraft Agreement. On or about January 28, 2025, Starfighters International and Aerovision verbally agreed to amend the Aircraft Agreement regarding the Aircraft Transactions, pursuant to which:

(i) Starfighters International may elect not to proceed with Phase 3 and/or Phase 4;

(ii) The initial deposit advance of $5,000,000 is broken down into two payments of $2,500,000 each, with the first payment to be made on or before January 31, 2025 (which was paid on January 24, 2025), and the second payment to be made within ten (10) days of Aerovision executing a binding agreement to acquire a minimum of eight F-4 Phantom II aircraft from an alternative supplier(s) (second payment of $2,500,000 was paid on March 3, 2025);

(iii) The due date for payment associated with Phase 2 is amended to be within five (5) days of Aerovision providing confirmation of shipping of the F-4 Phantom II aircraft to the Corporation from the point of origin;

(iv) The due date for payment associated with Phase 3, if Starfighters International elected to proceed, is amended to be October 31, 2025; and

(v) The due date for payment associated with Phase 4, if Starfighters International elected to proceed, is amended to be January 31, 2026.

Hypersonic R&D and T&E Test Bed

Hypersonic technology and its commercial applications is an emerging sector in aerospace. The Corporation's unique position as one of the only commercial entities with first stage jet aircraft capable of sustained MACH 2 flight, combined with its ability to launch targeted altitude payloads, allows it to capitalize on the burgeoning hypersonic market.

The potential for the Corporation's hypersonic business is multifaceted. Firstly, there is a growing demand for hypersonic testbeds in both the defense and commercial sectors. The Corporation's involvement in the Hypersonic and High-Cadence Airborne Testing Capabilities ("HyCAT") initiative, in partnership with Innoveering LLC and under the auspices of the Defense Innovation Unit of the U.S. Department of Defense, showcases the Corporation's capability and readiness to meet these demands.

Moreover, the limited availability of wind tunnel time for hypersonic research in the United States opens a significant market opportunity for the Corporation. The Corporation's fleet of Lockheed F-104 aircraft can serve as an effective alternative for delivering practical data results swiftly and predictably, a service in demand from government and private sector clients engaged in hypersonic research and development.

Additionally, the Corporation's collaborative efforts with other contractors and partners in the HyCAT program, such as GE Aerospace and Spectre Propulsion, indicate a strong potential for joint ventures and partnerships. These collaborations could lead to advancements in propulsion technologies and guidance systems, further enhancing the Corporation's offerings in the hypersonic market.

Supersonic Platform for Testing and In-flight Services

Utilizing the supersonic speed and flight profile characteristics of the Lockheed F-104, the Corporation has performed research and development services for several commercial, civilian, academic, and defense clients. These services include:

-

Captive carry payload testing;

-

Windstream testing with flight conditions that mirror supersonic or launch conditions;

-

Payloads for high altitude and hypersonic testing;

-

Termination flight system testing;

-

Space flight hardware testing and qualification;

-

Suborbital spaceflight simulation;

-

Supersonic and hypersonic research; and

-

Hardware testing, including batteries, optics, receivers/transmitters.

Defense, Civil, Academic and Commercial Services

The Corporation also provides a number of defense and commercial services to its clients, including:

-

Jet warbird training & familiarization;

-

Adversary air training support;

-

Video production and photography;

-

Human factors and flight physiology testing; and

-

Avionics testing and qualification.

Pilot and Astronaut Training - Supersonic

The Corporation provides a training platform for pilots who will fly the next generation of supersonic commercial aircraft. The commercialization potential extends beyond testing services. The Corporation's expertise and capabilities position them to develop and offer innovative solutions in supersonic travel and transportation. The emerging market for supersonic passenger travel and ultra-fast cargo delivery is still in its infancy, but the Corporation has already been working with companies such as Boom Aviation to provide pilot training and other testing. The Corporation aims to leverage both its pilot training and testing capabilities to develop a role in this space.

The Corporation has authorization from the FAA that permits the Corporation to use the space above NASA's Kennedy Space Center for pilot training and the Corporation is currently the only civilian company that is permitted to do so. A FAA Letter of Authorization along with a Letter of Deviation Authority allows licensed pilots to receive type-specific training in the same jets that NASA has used for decades to prepare their astronauts for spaceflight and to conduct aeronautical research. This limited-access training is designed to enhance confidence and flight safety through comprehensive ground training sessions and back-seat flight operations in the controlled airspace above NASA's Kennedy Space Center and the United States Space Force's Range over the Atlantic Ocean. In addition to pilot training, the Corporation also offers suborbital space flight participants the opportunity to experience a real work flight profile environment.

Competition

The industry in which the Corporation operates is subject to intense technological and regulatory change. We face, and will continue to face, competition from other companies. Some of these competitors can be expected to have longer operating histories and more financial resources and experience than us. Increased competition by larger and better-financed competitors could materially and adversely affect the business, financial condition, results of operations or prospects of the Corporation. Because of the early stage of the industry in which the Corporation operates, the Corporation expects to face additional competition from new entrants. To become and remain competitive, the Corporation will require capital for research and development, asset improvement and pilot training, sales and marketing efforts, capital expenditures, inventory purchases, investor relations, the repayment of outstanding loans and general corporate purposes. The Corporation may not have sufficient resources to maintain its operations on a competitive basis, which could materially and adversely affect the business, financial condition, results of operations or prospects of the Corporation.

The Corporation's primary sources of competition fall into three (3) categories:

-

companies providing dedicated and rideshare launch vehicles to deliver small payloads to generic and custom planes/inclinations and altitude trajectories, such as Northrop Grumman, SpaceX, United Launch Alliance (a joint venture between Lockheed Martin Corporation and The Boeing Corporation) and Rocket Labs7, as well as established Russian, Indian, Chinese, European, and Japanese launch providers;8

-

companies that are reported to have plans to provide launch vehicles that can deliver payloads to a range of planes/inclinations and altitude trajectories;9 and

7 Each of such entities have longer operating histories, experience and more financial resources than the Corporation.

8 Including the following: (i) Russia: Roscosmos, a state-owned entity; (ii) China: CASIC (which operates Expace), a state-owned entity, and private startups such as LandSpace, i-Space, Space Pioneer and Galactic Energy; (iii) India: Skyroot Aerospace and Agnikul Cosmoslt; (iv) Japan: Mitsubishi Heaviy Industries H3 Rocket; (v) India: Avio S.p.A - Vega family of small launch vehicles; (vi) Arian Group, as well as at least ten small launchers, each of which do not currently appear to meet launch goals.

9 Including SpaceX, United Launch Alliance, Rocket Lab, Firefly, Northrup Grumman, Blue Origin, as well as Russian, Indian and Chinese launch vehicles.

- companies that perform research into hypersonic rockets10 and components, wind tunnel testing, satellite and/or rocket component testing.

In the market in which the Corporation operates, the principal competitive factors include:

-

equipment flight history, heritage, and reliability;

-

equipment flight profile characteristics, including speed, range, maneuverability, flexibility, and reusability;

-

launch schedule timeline and flexibility;

-

ability to customize products to meet specific needs of the customer;

-

jet performance and technical features; and

-

price.

Competitive Strengths

The Corporation's competitive strengths include:

Multiple Revenue Streams

The Corporation is committed to developing and leveraging multiple revenue streams. By diversifying its potential revenue sources, the Corporation can reduce its dependence on any single product or service offering, making it more resilient in the face of market fluctuations and economic downturns. Furthermore, the Corporation's potential to generate revenue through multiple channels allows it to take advantage of opportunities for growth and expansion that may not be available to companies with a narrower focus.

Limited Competition for Direct Small Satellite Launch

While the overall space industry is highly competitive, the niche market for small and micro satellite launches is relatively untapped, with only a handful of companies operating in this space. This presents a significant opportunity for the Corporation to capture market share and establish itself as a leader in this rapidly growing segment. Additionally, the Corporation's position as one of the few companies offering cost-effective, reliable, and flexible small satellite launch services provides a significant competitive advantage over potential competitors.

Proven Operational History

The Lockheed F-104 has a long and proven track record of successful operations with the U.S. Air Force and at NASA, as well as with various armed forces around the world. It has been demonstrated that the jet can be successfully used to launch rockets into space. Furthermore, our location at KSC has enabled us to connect with a broad range of potential customers and partners, many right on the KSC campus. The Corporation was invited to KSC by Space Florida, the public-private partnership responsible for promoting and developing Florida's aerospace industry. Space Florida was created by the Florida Legislature to sustain Florida's position as a global space leader, and it is responsible for managing the commercialization of KSC. Our relationship with Space Florida has provided us with access to capital (including the Space Florida Loan discussed under "Description of Material Indebtedness - Notes Payable"), infrastructure and other resources that have evolved over time.

While at the KSC, the Corporation has successfully managed its operations and has established a reputation for delivering high-quality products and services to its customers, worked professionally with KSC personnel and operated as the first fixed wing provider at KSC, all with no mishaps in-flight for over 15 years. This has not only strengthened the Corporation's brand but also instills trust and confidence in the Corporation's stakeholders. Moreover, the Corporation's operational history has allowed it to refine its processes, optimize efficiency, and enhance its offerings, enabling the Corporation to deliver superior value to potential customers. This experience gives the Corporation a significant competitive advantage over new entrants to the market who lack the institutional knowledge and industry-specific expertise that comes with an established operational history.

10 Including Rocket Lab, which successfully launched the JENNA mission, a suborbital flight under its Hypersonic Accelerator Suborbital Test (HASTE) program, from Wallops Island, Virginia, on September 22, 2025.

Location

The Corporation has been located at the KSC space port since 2009. As one of the world's premier space launch facilities, the KSC offers unparalleled access to launch pads, ground infrastructure, and a highly skilled workforce. The Corporation holds an existing range user agreement with the US Space Force, which allows the Corporation access to and use of the Cape Canaveral range. The Corporation, through Starfighters International, is a party to a Memorandum of Agreement dated March 28, 2023 (the "MOA") with Space Launch Delta 45 ("SLD45"). Pursuant to the terms and conditions of the MOA, SLD45 provides support to the Corporation for its test flights at the Eastern Range. The MOA further provides that its purpose is to establish Starfighters International as an official ranger which will permit Starfighters International to establish SLD45 Job Order Number Accounts and directly reimburse SLD45 for future range support. Being located in close proximity to this hub of the global space industry enables the Corporation to rapidly respond to market opportunities, minimize launch-related costs, and reduce launch lead times. Furthermore, the Corporation's presence at the KSC enables it to leverage the significant industry partnerships and collaborations that exist in the region, fostering innovation and driving growth for the Corporation's business.

MIASP, the Corporation's new Midland facility was strategically chosen to increase its capacity, improve operational resiliency and flexibility, and bolster the United States' hypersonic testing capabilities. MIASP is the site of a proposed high-speed airspace corridor capable of accommodating a variety of high-speed missions to include subsonic, supersonic, hypersonic and point-to-point suborbital missions for both miliary and commercial applications.11

Lower Cost

Using the Lockheed F-104 as a reusable first stage allows the Corporation to lower its operational and capital expenditures compared with disposable rockets. Additionally, the Lockheed F-104 has a lower fuel consumption compared to rockets.

Launch Flexibility

Unlike traditional rocket launches, a jet-based system offers significant launch flexibility, enabling the Corporation to rapidly respond to changes in launch schedules, weather conditions, and other operational factors. The use of a jet as the first stage allows the Corporation to launch in multiple configurations and flight profiles, including a wider range of altitude, angle, and trajectory, compared to rockets launched at the same location.

Launch Transferability

The Corporation's jet-based system allows us to conduct launches from a wider range of locations, including potentially all permitted space ports worldwide, further expanding the Corporation's launch flexibility.

11 https://www.mrt.com/news/local/article/Study-confirms-feasibility-of-high-speed-airspace-17062625.php

Unique Capabilities

The Lockheed F-104 is a unique supersonic research platform due to its exceptional altitude and speed capabilities. It is the only commercial supersonic platform currently available in the world. The Lockheed F-104 was designed specifically for high-altitude flight and could achieve altitudes of over 100,000 feet. This makes it an ideal platform for conducting research in the upper atmosphere and beyond, where few other aircraft can go. Additionally, the Lockheed F-104 can fly at speeds of MACH 2 or higher, allowing it to conduct supersonic flight testing and research that is not possible with other available aircraft. The Lockheed F-104's unique combination of altitude and speed capabilities made it an invaluable research platform for a range of commercial, scientific, and military applications, from studying the upper atmosphere to testing advanced rocket systems.

Growth Strategy

The Corporation is pursuing the following growth strategies:

Access Backlog of Small Satellites

If obtained, a FAA launch license would allow the Corporation to access a backlog of small satellites waiting for launch. By offering its launch services, the Corporation can address the demand for satellite launches and contribute to reducing the backlog. This strategy can provide another potential revenue stream for the Corporation and position it as a reliable launch provider in the commercial space industry.

Capitalize on Hypersonic Research

The Corporation aims to leverage the increase in spending on hypersonic research by the U.S. Government.12 With the Lockheed F-104 being the only commercial, non-rocket platform capable of testing at the required speeds, the Corporation intends to position itself as a key player in this field. By offering their services and expertise in hypersonic research the Corporation can attract government contracts and collaborations.

Real-World Wind Tunnel Testing

The Corporation's Lockheed F-104 platform provides the unique advantage of conducting wind tunnel testing in a real-world environment. This capability allows the Corporation to offer more accurate and reliable data to clients in industries such as aerospace, defense, and engineering. By highlighting this advantage, the Corporation believes it will attract clients seeking comprehensive and realistic wind tunnel testing.

Expand Pilot Training

The Corporation may acquire the necessary licenses to expand its pilot training operations. By increasing the number of flights per year, potentially up to 120 flights, the Corporation can cater to a larger pool of aspiring pilots. This expansion can help the Corporation generate and grow revenue and establish the Corporation as a provider of advanced pilot training services.

Target Growth in R&D Testing

The Corporation can leverage the unique abilities and flight profiles of the Lockheed F-104 to target growth in research and development (R&D) testing. The Corporation can position itself as a reliable partner for companies and organizations involved in satellite and rocket component testing. By offering their platform and expertise, the Corporation believes it will attract clients seeking high-speed, high-altitude testing capabilities.

12 Ibid.

Overall, by capitalizing on its unique capabilities and advantages, the Corporation intends to position itself as a pilot in satellite launches, hypersonic research, wind tunnel testing, pilot training, and other R&D testing. These strategies will enable the Corporation to achieve growth and establish a strong presence in the industry.

Property

The Corporation does not currently own, rent, or lease any property other than its hangars located at the KSC at Reusable Launch Vehicle Hangar, Hangar Rd, Cape Canaveral, FL, 32920, and at MIASP at The George H.W. and Barbara Bush Commemorative Center, 9600 Wright Dr., Midland, TX, 79706, as discussed below. The Corporation may enter into other lease agreements for office space in the future; however, no assurance can be provided that this will occur. The Corporation currently has no plans to acquire any real property.

Lease Agreement with Space Florida

The Corporation leases its premises located at the KSC at Reusable Launch Vehicle Hangar, Hangar Rd, Cape Canaveral, FL, 32920 pursuant to the terms and conditions of a Site Occupant Lease Agreement No: C20756 between Space Florida and Starfighters International dated June 1, 2022, as amended on June 1, 2023, June 1, 2024 and June 1, 2025 (the "Lease Agreement"). The term of the Lease Agreement began on June 1, 2022, and continues until May 31, 2026.

Pursuant to the Lease Agreement, the Corporation leases (i) 11,069 square feet of the Reusable Launch Vehicle Facility, (ii) 2,000 square feet of the Convoy Vehicle Enclosure, and (iii) 2,500 square feet of area beside the Aircraft Ground Equipment Shed (collectively, the "Premises"). The Corporation is required to pay a monthly fee of $10,682.50 to lease the Premises. Additionally, the Corporation is required to pay a RLV Common Area Maintenance fee of $4,612.08 per month and various other fees (including license fees) and costs in relation to the Corporation's lease of the Premises. The Corporation will be subject to a $500 fee per day if any Corporation property remains outside the Premises for more than 24 hours

Hangar Lease Agreement at MIASP

On June 1, 2025, the Corporation entered into a commercial hangar lease agreement with the City of Midland for the lease of hangar facilities at MIASP in relation to its commitments in the Economic Development Agreement. The lease is for $18,535 per month with a term of one year, which may be extended upon mutual written consent for up to four additional years.

Economic Development Agreement with Midland Development Corporation

On October 7, 2024, the Corporation, through its subsidiary Starfighters Texas, entered into a 10-year economic development agreement (the "Economic Development Agreement") with the Midland Development Corporation ("MDC") for the expansion of its operations to MIASP, with effect from September 24, 2024.

The Corporation will use the site for supersonic flight testing, training, and research and development, including suborbital launches and high-speed aircraft operations.

Suppliers

We obtain our replacement and spare parts, components, sub systems, and equipment from suppliers that we believe to be reliable and reputable. All current suppliers have been, and continue to periodically be, internally reviewed to ensure that they are able to supply materials that meet our specifications and quality control requirements. Potential new suppliers also follow this process. The majority of our requirements are consumables in nature, including liquid oxygen, fuel, and tires. The first two of these items are supplied by KSC space port services. Disruptions in the supply of key raw materials or components and difficulties in the supplier qualification process, as well as increases in prices of raw materials, could adversely impact us. See "Risk Factors - Risks Related to our Business and Industry - We depend on several specialized suppliers for the majority of specialized supply needs. Disruptions in the supply of key raw materials or components and difficulties in the supplier qualification process, as well as increases in prices of raw materials, could adversely impact us."

Additionally, Starfighters International has entered into an asset purchase agreement dated October 1, 2021, as amended on December 29, 2023 (the "Hypersonic APA"), with Hypersonic Group Inc. ("HGI"). Pursuant to the terms and conditions of the Hypersonic APA, Starfighters International has agreed to purchase 22 J79-19 engines from HGI for an aggregate purchase price of $2,200,000 (the "Purchase Price"). The Corporation intends to use the engines as replacements to extend the useful life of its Lockheed F-104 aircraft. Pursuant to the Hypersonic APA, Starfighters International agreed to (i) pay HGI a deposit of $250,000 by December 31, 2022, (ii) pay HGI $500,000 on March 30, 2023, (iii) pay HGI $50,000 immediately following December 29, 2023, (iv) pay HGI $50,000 within five (5) business days of March 31, 2024 in the event that Starfighters International has not made the initial submission of the Reg A Offering Statement to the SEC on or before March 31, 2024, and (v) pay HGI the remaining balance of the Purchase Price ($1,350,000) within five (5) business days of the completion of the Reg A Offering. To date, Starfighters International has paid an aggregate of $1,300,000 of the total purchase price required pursuant to the Hypersonic APA and is currently negotiating a further extension with HGI. Rick Svetkoff, the Corporation's President and Chief Executive Officer, owns 50% of HGI and is a director of HGI. Accordingly, HGI is a related party of the Corporation.

Development work on StarLaunch launch platform is contracted to industry partners.

Government Regulation

Compliance with various governmental regulations has an impact on our business, including our capital expenditures, earnings, and competitive position, which can be material. We incur or will incur costs to monitor and take actions to comply with governmental regulations that are or will be applicable to our business, which include, among others, federal securities laws and regulations, export and import control, economic sanctions and trade embargo laws and restrictions and regulations of the Department of Transportation ("DoT"), the FAA, the Department of Defense ("DoD"), and NASA and other government agencies in the U.S. The following discussion summarizes the principal elements of the regulatory framework applicable to our business. Regulatory requirements, including but not limited to those discussed below, affect our operations, and increase our operating costs, and future regulatory developments may continue to do the same. See "Risk Factors" for a discussion of material risks to us, including, to the extent material, to our competitive position, relating to governmental regulations, and see "Management's Discussion and Analysis" together with our consolidated financial statements, including the related notes included therein, for a discussion of material information relevant to an assessment of our financial condition and results of operations, including, to the extent material, the effects that compliance with governmental regulations may have upon our capital expenditures and earnings.

Our areas of operations are primarily covered by two separate sets of Regulation (i) the DoT - FAA Aviation Safety, which governs our operation of experimental aircraft as all privately owned former military aircraft are considered experimental aircraft, and (ii) FAA AST (The Office of Commercial Space Transportation), which governs our operation as a launch operator.

Operator of Experimental Aircraft Regulation

All experimental aircraft engaged in air flight in the United States are subject to regulation by the DoT. Absent an exemption, no experimental aircraft may provide air flights of researchers or property/payloads without first being issued a DoT FAA Letters of Deviation Authority.

Part 91 of the FAA Regulations

Operators of experimental aircraft are regulated by the FAA, an agency within the DoT, primarily in the areas of flight safety, experimental aircraft operations and aircraft maintenance and airworthiness. The FAA issues air experimental aircraft operating certificates and aircraft airworthiness certificates, prescribes maintenance procedures, oversees airport operations, and regulates pilot and other employee training. From time to time, the FAA issues directives that require experimental aircraft to inspect, modify or ground aircraft and other equipment, potentially causing the Corporation to incur substantial, unplanned expenses.

Part 450 of the FAA Regulations

Part 450 of the FAA Regulations is the streamlined launch and re-entry licensing requirements that went into effect in 2020, which was welcomed legislation for companies like us. Part 450 consolidated multiple regulatory regimes into one set of requirements for all vehicle types, which are performance-based requirements utilizing flexible means of compliance, and a single license may authorize operations at multiple sites and extensive coordination with DoD and NASA to minimize duplicative requirements for operators.

The application evaluation consists of five major components:

-

a Policy Review;

-

a Payload Review;

-

a Safety Review;

-

a Maximum Probable Loss (MPL) Determination; and

-

an Environmental Review.

Part 450 allows incremental approvals of the safety review. There are tremendous benefits of incremental review of a modular application, which reduces regulatory uncertainty with early approvals.

There are also sections in Part 450 which have a direct impact on the ability to launch but do not affect safety or hardware, namely environmental review and financial responsibility. Since our StarLaunch vehicles are relatively small compared to many other rockets and the propellants and procedures are well understood, we believe that environment compliance can be satisfied. Financial responsibility is a matter of finding insurance coverage: since the StarLaunch vehicles are small and the maximum impact is low, we believe that we will be able to find affordable insurance.

While there may be delay and additional costs to comply with Part 91 and Part 450 of the FAA Regulations, we already comply with Part 91 and are using experts such as Integrated Launch Services to complete and comply with Part 450, and because the process with the FAA is iterative or repetitive, we believe we will be able to acquire the necessary waivers and license(s) to launch.

Environmental Regulation

While the regulations for experimental aircraft are not as stringent as the airline industry, they are subject to increasing federal, state, local and international environmental regulations, including those regulating emissions to air, water discharges, safe drinking water and the use and management of hazardous substances and wastes. We endeavor to comply with all applicable environmental regulations. We maintain compliance primarily with NASA environmental regulations since that is the location of our primary operating site. By complying with the NASA regulations for ground operations and FAA regulations for flight operations, we believe we are following all federal requirements.

Employees

The Corporation currently has no employees and utilizes independent contractors for general operations, including its senior management team, and partners with third party providers for research and development. We do not currently have any pension, annuity, profit sharing, or similar employee benefit plans, although we may choose to adopt such plans in the future.

We plan to engage additional contractors and consultants from time to time on an as-needed basis to consult with us on specific corporate affairs, or to perform specific tasks in connection with our business development activities.

History

For the year ended December 31, 2023

On February 24, 2023, the Corporation issued the first out of six tranches of secured convertible debentures (the "Debentures") in the principal amount of $4,413,400. The Debentures bear interest at five percent (5%) per annum payable on the Maturity Date and secured by the assets of the Corporation pursuant to a security agreement entered into between the Corporation and Computershare dated February 24, 2023 (the "Security Agreement"). The Debentures are due twenty-four (24) months following the issuance of the first tranche, being February 24, 2025; however, on December 19, 2024, the holders (the "Debentureholders") adopted an extraordinary resolution (the "Debenture Amendment Resolution") to approve certain amendments, which included extending the maturity date from February 24, 2025 to December 31, 2025 (the "Maturity Date"). The Debentures are governed by a debenture indenture entered into between the Corporation and Computershare, dated February 24, 2023 (the "Indenture"), as amended pursuant to the first supplemental convertible debenture indenture entered into between the Corporation and Computershare, dated December 19, 2024 (the "First Supplemental Convertible Debenture Indenture") as a result of the Debenture Amendment Resolution. The Indenture, as amended, also provides that in the event of a Public Listing prior to the Maturity Date, the principal amount of the Debentures plus any accrued and unpaid interest thereon will automatically convert into Common Shares at a conversion price equal to the lessor of (i) a 40% discount to the price per security of the Corporation's initial public offering in the event of a Public Listing, and (ii) $4.00, and such Common Shares issued will be subject to a six (6) month hold period from the completion of the Public Listing, or such other length of time as may be determined by the Corporation at the time of the Public Listing. Pursuant to the terms and conditions of the Security Agreement, the Corporation has granted Computershare, for the benefit of the Debentureholders, a security in and to the property of the Corporation including, but not limited to, it accounts, money, equipment, and goods.

On July 14, 2023, the Corporation issued the second tranche of Debentures in the principal amount of $804,100, which, taken together with the first tranche of Debentures, resulted in the Corporation completing the Bridge Financing.

On September 6, 2023, the Corporation issued 400,000 Warrants (the "2023 Warrants"), having substantially similar terms as the 2022 Warrants. The Corporation also issued 2,750,000 Warrants (the "LH Warrants") pursuant to the terms and conditions of a consulting agreement dated June 23, 2023 between the Corporation and Little Hill (the "Little Hill Consulting Agreement"). The LH Warrants have substantially similar terms as the 2022 Warrants and the 2023 Warrants.

On September 15, 2023, the Corporation issued the third tranche of Debentures in the principal amount of $448,000.

On October 27, 2023, the Corporation entered into an engagement agreement (as amended by agreement dated June 24, 2024, the "Original Engagement Agreement") with Digital Offering, LLC ("Digital Offering"), whereby Digital Offering agreed to act as lead selling agent in connection with the Corporation's Reg A Offering. Under no circumstances will Digital Offering be obligated to underwrite or purchase any of the Common Shares for their own account or otherwise provide any financing. Pursuant to the Original Engagement Agreement, the Corporation will pay to Digital Offering a cash commission equal to one percent (1.0%) (the "Cash Fee") of the gross offering proceeds received by the Corporation from the sale of the Common Shares pursuant to the Reg A Offering. In addition to the Cash Fee, the Corporation agreed to issue to Digital Offering (and/or its designees) a warrant (the "Agent's Warrant") to purchase a number of Common Shares (such Common Shares being the "Warrant Shares") equal to 1.0% of the total number of Common Shares sold in the Reg A Offering, which shall be exercisable, in whole or in part, commencing on the issuance date and expiring on the five-year anniversary of the date of commencement of sales in the Reg A Offering, at an exercise price of $3.59 per Warrant Share, which is equal to 100% of the purchase price of the Common Shares.

On December 28, 2023, the Corporation issued the fourth tranche of Debentures in the principal amount of $680,500.

For the year ended December 31, 2024

On May 17, 2024, the Corporation issued the fifth tranche of Debentures in the principal amount of $501,400.

On August 15, 2024, the Corporation issued the sixth tranche of Debentures in the principal amount of $242,000.

On September 6, 2024, the SEC qualified the Corporation's Reg A Offering of up to 11,142,061 Common Shares at a purchase price of $3.59 per Common Share on a "best efforts" basis for gross proceeds of up to $40,000,000.

On October 7, 2024, the Corporation, through its subsidiary, Starfighters Texas, entered into the Economic Development Agreement with MDC having an effective date of September 24, 2024, whereby MDC has agreed to provide certain incentives to Starfighters Texas as consideration for Starfighters Texas's: (i) expansion of its business operations to MIASP, (ii) creation and retention of primary jobs within the corporate limits of the City of Midland, and (iii) relocation of certain capital assets and equipment at MIASP. In connection with the Economic Development Agreement, MDC and Starfighters Texas agree to collaborate to obtain FAA approval and certification of a high-speed airspace corridor between MIASP and Spaceport America, utilizing supersonic aircraft owned by the Corporation or its subsidiaries. In addition, Starfighters Texas agrees to exercise reasonable efforts to employ Midland residents and to advertise the availability of job opening in Midland, Texas, and additionally, when it is not possible to hire Midland residents, Starfighters Texas will exercise its best efforts to recruit new residents to live in Midland, Texas, and to advertise the availability of job openings in Midland, Texas, and additionally, when it is not possible to hire Midland residents, Starfighters Texas will exercise its best efforts to recruit new residents to live in Midland, Texas, and to advertise the availability of job openings in Midland, Texas.

Starfighters Texas's obligations under the Economic Development Agreement include: (i) the relocation of assets to a facility at MIASP in the amount of assets totaling $60 million by December 31, 2025 and assets totaling $78 million by December 31, 2027; (ii) to use commercially reasonable efforts to relocate, create, and/or maintain full-time jobs with three (3) full-time jobs as of December 31, 2026, ten (10) full-time jobs as of December 31, 2030, fifteen (15) full-time jobs as of December 31, 2031, twenty (20) full-time jobs as of December 31, 2032 and twenty-three (23) full-time jobs as of December 31, 2033; (iii) complete annual compliance certifications setting out the full-time jobs created and maintained, and the total assets located at MIASP as of the last day of such compliance year; (iv) continuously conduct its business during the term of the Economic Development Agreement; (v) enter into a temporary hangar lease, short-term hangar lease and long-term hangar lease as and when such become available and any long-term hangar lease is subject to satisfaction of MDC's obligation under the Economic Development Agreement related to new hangar construction.

MDC's obligations under the Economic Development Agreement include: (i) providing Starfighters Texas with relocation costs as set out in Exhibit C to the Economic Development Agreement up to an amount of $2,051,560; (ii) during the terms of a temporary hangar lease and short-term hangar lease, provide Starfighters Texas a monthly reimbursement in an amount not to exceed $8,000; and (iii) entering into a long-term ground lease with the City of Midland on real property located at MIASP and to construct a new hangar facility with approximately 100,000 square feet of usable space and to enter into a long-term hangar sublease with Starfighters Texas for same. The Economic Development Agreement shall terminate (i) on the tenth anniversary of the effective date, (ii) when terminated by mutual agreement of the parties, or (iii) when terminated as set forth in Section VIII or Section X.E of the Economic Development Agreement.

On October 23, 2024, the Corporation conducted an initial closing of the Reg A Offering pursuant to which it sold 1,084,400 Common Shares for gross proceeds of $3,892,996. In connection with the initial closing, the Corporation also issued 10,844 Agent's Warrants to Digital Offering which are exercisable for 10,844 Warrant Shares at an exercise price of $3.59 per Warrant Share until September 6, 2029.

On October 29, 2024, the Corporation, SFI and Space Florida entered into an amendment to loan and security agreements (the "Amendment to Loan and Security Agreements"). See "Description of Material Indebtedness".

On November 11, 2024, the Corporation conducted a second closing of the Reg A Offering pursuant to which it sold 809,813 Common Shares for gross proceeds of $2,909,382.67. In connection with the second closing, the Corporation also issued 8,104 Agent's Warrants to Digital Offering, which are exercisable for 8,104 Warrant Shares at an exercise price of $3.59 per Warrant Share until September 6, 2029.

On November 29, 2024, the Corporation conducted a third closing of the Reg A Offering pursuant to which it sold 562,497 Common Shares for gross proceeds of $2,020,082.23. In connection with the third closing, the Corporation also issued 5,626 Agent's Warrants to Digital Offering which are exercisable for 5,626 Warrant Shares at an exercise price of $3.59 per Warrant Share until September 6, 2029.